An Investment Review of Alcon Inc. Since Its Spin-off from Novartis

- Modelyze Investments

- Jun 22, 2020

- 7 min read

Updated: Feb 20, 2022

Overview: Alcon Inc. (“ALC” or “Alcon” or “Company”), (NYSE: ALC; SWX: ALC), is the largest eye care company in the world, operating in the Health Care Supplies and Manufacturing industry. The company was founded in 1945 in the US, was acquired by a Swiss Subsidiary of Nestle S.A. in 1977, became a publicly traded company in 2002, was listed on NYSE as ACL until its merger into Novartis and privatization in 2011, was divested from Novartis in April 2019 and has been trading on NYSE and SWX under the ticker ALC ever since. The company has a long history of research, development, manufacturing, distribution and sale of full suite of eye care products within two business segments: Surgical and Vision Care and operating in over 70 countries, serving consumers in 140 countries. Company’s products are diversified both across a full spectrum of eye care vision and surgical products as well as geography with a global reach. As of 2019FYE, US has accounted for 41% of sales, while Europe accounted for 25%, Asia, Africa and Australia for 25% and Canada and LATAM for 9%. The company is focused on both organic and inorganic growth through acquisitions with sustainable near-term strategy of developing key products, accelerating innovation and new technology, expanding markets and geographies, expanding customer experience and improving margins. The company has made one of the largest R&D commitments in the eye care market, with the proven capabilities in the areas of optical design, material and surface chemistry with the primary focus of delivering new products to the patients and consumers. The company has owned approximately 1,900 patent families consisting of approximately 2,300 US patents and pending US patent applications and approximately 8,600 corresponding patents and patent applications outside the US as of 2019FYE. As part of a family group companies under Novartis umbrella, Alcon would have faced challenges in growth opportunities and maximizing the investment pipeline as many decisions are made to the benefit of the group, which might be at the detriment of the individual subsidiaries. Meanwhile, the asset based valuation of conglomerates such as Novartis less corporate expenses, could prove that the value of subsidiaries as a whole to be higher than the value of the conglomerate and hence, breaking down the conglomerate to stand alone companies could potentially add more value for investors. Alcon is currently in the second stage of the three-phase turn-around plan of fixing the foundation (2016–2017), executing the growth plan (2018–2020), and finally delivering leading-edge solutions (2021 and beyond). The company has a $30.12 billion market cap as of the date of the analysis, is categorized as a health care and technology large cap company and is manufacturing a diversified suite of non-discretionary eye care products with stable demand across the globe.

Financial Performance: Looking at the historical financial statements over the last five years, while differentiating between IFRS and Core operating results, Alcon has a strong cash flow quality with stable cash flow return on invested capital of 4% and 11.2 x interest coverage ratio as of 2019FYE. With a BBB investment grade balance sheet and a 20% book value debt to equity ratio as of 2020Q1 which is below Health Care Supplies industry average of 34%, Alcon has a strong balance sheet. Securing further debt financing in 2019Q1, Alcon has sufficient liquidity of $3.027 billion and $760 million cash, summing to 2.69% of the firm value as of 2020Q1. From an operating perspective on an unadjusted basis, operating and net margins are below industry average and negative, however, the Core Results margins are relatively stable with a 17% adjusted operating margins and 13% adjusted net margin as of 2020Q1. Return on capital and return on equity have been relatively stable over the last five years averaging at roughly 4%. These returns however are below Alcon’s cost of capital of 6.7% and cost of equity of 7.4% as of the date of the analysis. Consequently, operating efficiency is moderate. With a volatile and negative adjusted net income to net income, adjusted operating income to operating income and a volatile and negative CFO to net income, earning quality is low. As price to book and price to sales ratios are below peer median, valuation risk is low. The following graphs display the Alcon’s historical financial performance.

Corporate Governance: Alcon has six wholly owned subsidiaries in Japan, US and Switzerland. Institutional investors hold 62.4% of issued and outstanding shares, management and board hold 0.01% and public hold the remaining 37.5% outstanding shares. The board comprise of 10 members three of which (F. Michael Ball the ex-CEO, David J. Endicott the current CEO and Dr. Arthur Cummings) are not independent members with the previous Chief Executive Officer of the Alcon Division of Novartis assigned as chairman of the board. All board members and management team have significant expertise in the health care industry. Alcon has transparent corporate governance practices that are disclosed in their form 20-F; however, the significant ownership of institutional investors would potentially mean that during troubled times, institutional investors could sell their stake and move on without pushing for change in Management team’s performance and company’s operations.

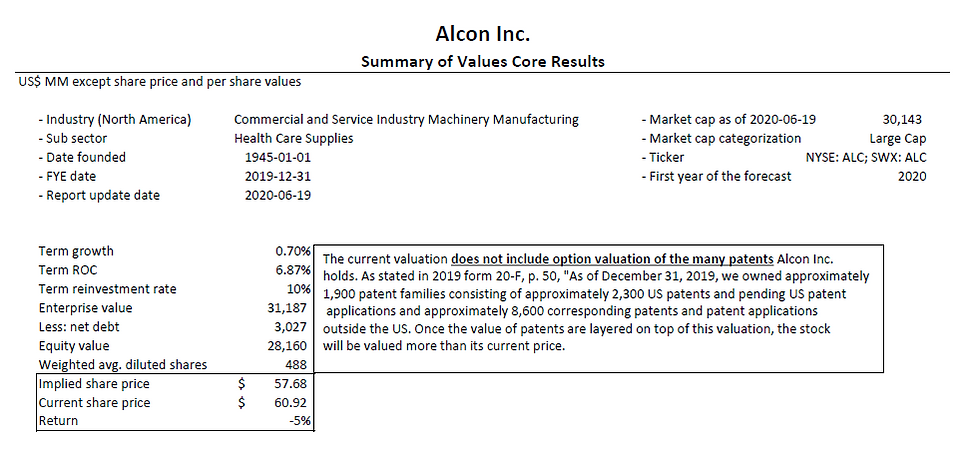

Valuation: With a 75-year track record in the healthcare technology industry, Alcon is in the mature stage of its corporate lifecycle and it is pushing for further growth and reinvestment over the next five years. With a global reach and net sales across North America, LATAM, Africa, Asia and Australia, Alcon business is well diversified and considering the country risk premium of these regions, the weighted average equity risk premium across all markets is calculated to be 6.26%. From risk quantification perspective, a cost of equity of 7.38% based on the bottom up beta approach of health care supplies and product industry and an after tax cost of debt of 2% led to a 6.7% cost of capital for purposes of intrinsic valuation. Consequently, the intrinsic valuation of Alcon shares as of the date of this post, while capitalizing the R&D expenses into operating income, led to a $57.68 share price and return to target of -5%. This valuation, however, excludes the option valuation of company’s patents; hence, the implied share price is deemed to be potentially higher.

Company has disclosed the global list of comparable firms in form 20-F. A peer group of companies can also be compiled controlling for differences across cashflows, growth and risk in the health care industry large cap participants. Looking at the median of 2020F multiples across the peer group disclosed in the company’s financial statements, Alcon is ever so slightly overvalued from a P/S and EV/Revenue perspective and properly valued from an EV/EBITDA perspective. However, looking across all health care large cap companies and running a regression across EV/Revenue as a function of fundamental drivers such as operating margins infers that Alcon is 36% undervalued.

As a large cap, popular, health care and technology company which has gotten significant coverage through 23 analysts, with very low bid ask spread and high trading volumes, value creation opportunities in the short term is small. In the long run however, given the non-discretionary nature of the products, continuous and growing demand, and operations in the growing industries such as health care and technology which had gotten a boost during and post COVID-19, the prices are expected to remain strong or rise. Consequently, the stock is a good candid for value preservation opportunities in an equity portfolio and especially post COVID-19 pandemic. The value of one USD investment in ALC since its spin-off relative to investments in S&P500, iShare Global Health Care ETF and iShare Global Tech ETF is displayed below. The Tech ETF continues to outperform the index, Health Care ETF and ALC.

Risk to Target Price: Risks associated with investments in Alcon include but not limited to supply chain risks, technological risks, commercialization risks, financial market, credit, liquidity and exchange rate risks, macroeconomic risks, a competitive, disruptive market, political and social risks, consolidation among distributors, retailers and healthcare providers, limited experience in pricing new products, legal risks, regulatory risks, tax risks and ESG risks.

Investment Philosophy: Inclusion of a stock in an equity portfolio depends on a variety of factors such as degree of risk aversion, time horizon and client’s tax status as well as other client or fund specific characteristics such as ESG constraints, degree of leverage, thinking style (Contrarian vs. Momentum), disposable income, allocated time to research, asset allocation and rebalancing, core beliefs about the markets, and degree of diversification across asset classes. Given the collection of investment philosophies at our disposal including: technical analysis, value investing, growth investing, information trading, arbitrage, market timing and passive indexing, each investment philosophy requires certain characteristics and satisfaction of a specific list of criteria to succeed in adopting and implementing the resultant investment philosophy. As the client’s and investor’s characteristics, abilities, personal situation and understanding and views about the market evolve over time, the investment philosophy must be revisited periodically. Given the current market conditions, if the investment strategies for equity portfolios are broken down into Bargain Basement, Distressed Equity, Safety at a Reasonable Price and Change Agents strategies, Alcon would fall under the Safety at a Reasonable Price bucket as many health care, technology and gold companies have been able to maintain their values YTD amid COVID-19. If one has the flexibility to switch styles between growth and value investing and sector rotate, one can actively manage the assets by spreading the bets across four categories of Bargain Basement, Distressed Equities, Safety at A Reasonable Price and Change Agents given the market views, degree of risk aversion, and client characteristics, or, passively indexing an ETF in the sectors one believes to perform the best given the market conditions while applying enhanced indexing. Many active management strategies are in fact enhanced indexing. A comprehensive quantitative analysis of excess returns in the optimization process of the paper portfolio including the hedging strategies must be conducted to determine the stock weights within the overall portfolio. This analysis is outside the scope of this investment review.

Data in this post is collected as of Jun 19, 2020.

Comments